BROWSE OUR BLOGS TO LEARN MORE ABOUT RETIREMENT PLANNING, TAXES, AND MORE!

A History of Modern Credit and Why It’s Important Today

You’re probably familiar with credit in your everyday life. Many Americans have credit cards, use them for everyday expenses, and (most) try to act responsibly to increase their credit scores. But where did it all come from? How did “credit” come about? And why is it such a prevalent part of our daily lives? The History of the US Credit [...]

Celebrating National Credit Awareness Month

March is the start of spring, which means the chilly weather is subsiding, the days are getting longer, and you might even begin planning your summer plans. But March is also National Credit Awareness Month. While cleaning out your gutters or planting seeds might be on your to-do list, this month serves as a vital reminder to perform a different [...]

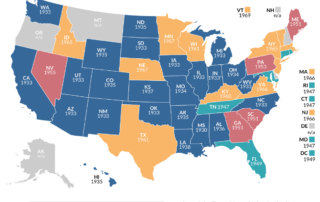

A History of the Sales Tax

Before we take a peek into the past to see how sales tax became a part of our lives, let’s define our terms. Sales tax is a tax on the sale or exchange of an item or service and is usually paid by the consumer or purchaser. It is a source of revenue for state and local governments to fund [...]

How Home Sales Are Taxed: What Every Homeowner Should Know

Selling a home is a significant financial event, and understanding the tax implications can help homeowners protect their profit and avoid unexpected liabilities. When you sell your residence, the gain you realize may be subject to capital gains tax, but in many cases, favorable tax rules can help reduce that tax burden. Let’s take a look at how the tax [...]

Income Tax vs. Capital Gains Tax: What’s the Difference?

Understanding the difference between income tax and capital gains tax is a key part of smart financial planning. While both are ways the government collects revenue, they apply to very different types of money you receive. Here are the questions you most likely have, and the answers that can help you understand the basics of these two tax categories. Q: [...]

Tax Updates for 2026: Key Things to Know This Year

Thanks to the permanent changes made by the “One Big Beautiful Bill Act” (OBBBA) and the annual inflation adjustments from the IRS, the 2026 tax year brings some changes you might want to make note of. Getting a handle on these updates can help you plan out your financial moves throughout this year, so let’s take a look at some [...]

A Brief History of the Social Security COLA

Although to some of us it may seem as if Social Security has always been around, that isn’t the case. The Social Security Act was signed into law by President Franklin D. Roosevelt on August 14, 1935. Its aim was to address the economic hardships of the Great Depression and provide an income source, specifically for the elderly. But automatic [...]

A How-To Guide to Your “my Social Security” Account

While the Social Security Administration will still mail you a statement once a year if you’re over the age of 60, they really encourage everyone to create a “my Social Security” account for better security and easier access to forms and information. With an online account, you don’t have to wait for the mail to arrive or worry whether you missed your letter, and [...]

Do You Have What You Need To Plan For Retirement?

Take Our StayRetired™ Planning Quiz

Our quiz is meant to prepare you for our planning process. By answering our short quiz, you’ll know what you already have prepared and what you may need to think on before we begin crafting your perfect plan for retirement. If you’re unsure on any of the questions, that’s fine – just answer honestly, and we’ll fill you in on what you need to know.